We use cookies to make your experience better. To comply with the new e-Privacy directive, we need to ask for your consent to set the cookies. Learn more.

All you need to know about the 2018 vehicle tax changes.

Vehicle Tax Changes in 2017.

As of April 1 2017, millions of drivers faced increased vehicle tax contributions as a result of revisions to the law regarding both petrol and diesel cars. It saw a rise in first year contributions and set a standard rate of £140 thereafter for newly registered combustion cars. If the value of your new car, however, surpassed £40,000 this figure rose considerably to £450 yearly. This reflected the government’s commitment to improved air quality within the UK. It was a move to direct car buyers towards the electric alternatives that remained exempt from paying any vehicle tax at all.Vehicle Tax Changes in 2018: part one.

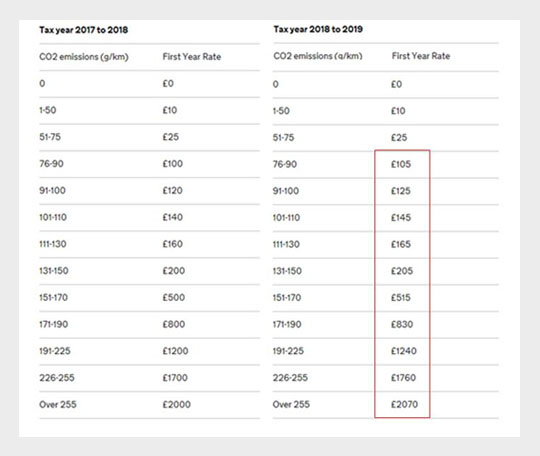

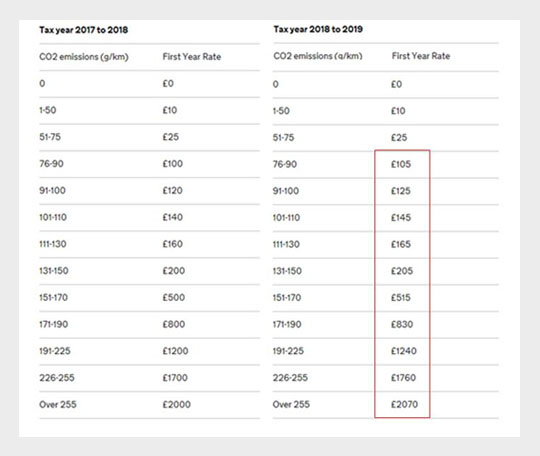

There are two parts to the legislation that comes into effect from 1 April 2018. The first simply adds to the increase in first year vehicle tax rates that we witnessed last year. It affects cars with C02 emissions level of 75g/km or more and could, once again, therefore affect petrol or diesel cars.

Vehicle Tax Changes in 2018: part two.

The second change applies only to diesel vehicles. It sees a new standard introduced to control levels of Nitrogen Oxides (NOx) emitted by diesel cars: those that pass are subject to the same first year increases as noted above, those that fail or remain untested are penalised with even greater charges. These increases are equal to one vehicle tax band higher than the vehicle in question. This new standard is known as the Real Driving Emissions Step 2 (RDE2) test. It now forms part of UK Type Approval testing and its predecessor, RDE1, was introduced in September 2017. Together, they dictate that no more than 0.080g/km of NOx should be emitted by a diesel car. You can find out more about the tests and how they work here.

You can find out more about the tests and how they work here.